No, Trust Wallet cannot freeze your account. It is a decentralized wallet that gives users full control over their assets. The security and access to the account depend entirely on the user managing their private keys and recovery phrase securely.

Understanding Trust Wallet’s Security Features

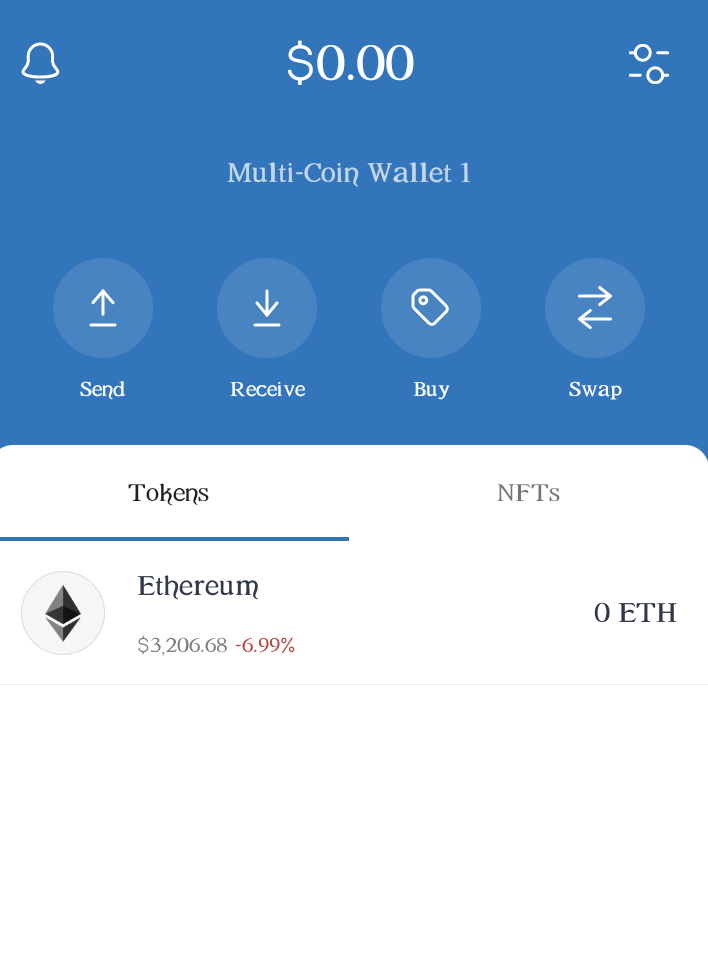

Trust Wallet is a widely used mobile cryptocurrency wallet known for its emphasis on user control, privacy, and security. It employs several layers of security measures to protect users’ assets while providing a user-friendly experience. Here’s a detailed look at how Trust Wallet ensures the safety of your digital assets and maintains user privacy.

How Trust Wallet Protects Your Assets

- Private Keys Stored Locally: Unlike centralized exchanges, Trust Wallet stores your private keys on your device. This means only you have access to your funds.

- Secure Enclave Technology: For devices that support it, Trust Wallet leverages Secure Enclave technology, providing an additional layer of security. This technology is designed to keep your private keys safe, even if your device is compromised.

- Industry-Standard Encryption: Trust Wallet uses advanced encryption standards to secure your wallet, ensuring that your account information and private keys are protected against unauthorized access.

The Role of Decentralization in Trust Wallet

- No Central Authority: Trust Wallet operates on a decentralized model, meaning there’s no central authority that controls your assets. This significantly reduces the risk of server downtime, government intervention, and centralized hacking attempts.

- Direct Blockchain Interactions: Transactions made through Trust Wallet are performed directly on the blockchain, offering transparency and reducing the risk of manipulation.

- Enhanced User Sovereignty: Decentralization empowers users with full control over their assets, allowing for seamless transactions without the need for intermediaries.

User Control and Privacy Measures

- Anonymous Usage: Trust Wallet does not require personal information to create or use the wallet, ensuring your privacy. Your identity remains anonymous, and your wallet activity is not tied to your personal identity.

- Customizable Security Settings: Users have the flexibility to adjust security settings according to their preferences, including enabling biometric access (fingerprint or facial recognition) for an added layer of security.

- Recovery Phrase Protection: Upon setting up the wallet, users are given a 12-word recovery phrase. This phrase is the key to restoring your wallet on any device, and Trust Wallet encourages users to keep it secure and private.

The Nature of Account Freezing

Account freezing is a significant action that can impact a user’s access to their financial assets. Understanding what it means to freeze an account, why it happens in traditional banking, and how it differs in the context of centralized versus decentralized wallets is essential for navigating the financial and digital asset world.

What Does It Mean to Freeze an Account?

- Restricted Access: Freezing an account refers to the temporary suspension of a user’s ability to access or use their funds and financial services. The user cannot make transactions, withdraw funds, or use any assets in the account.

- Protection Measure: It is often employed as a protective measure, either to prevent unauthorized access or as a response to suspicious activities that could indicate fraud, money laundering, or other illegal activities.

- Regulatory Compliance: Account freezing can also be a result of regulatory actions taken by financial authorities to ensure compliance with laws and regulations.

Common Reasons for Account Freezing in Traditional Banking

- Fraudulent Activity: Banks may freeze accounts if there are indications of fraud, such as unauthorized transactions or identity theft.

- Overdue Payments: Accounts can be frozen due to overdue payments or debt obligations that the account holder has failed to meet.

- Legal Orders: Courts may order an account freeze for various legal reasons, including divorce proceedings, disputes over the account’s funds, or as part of a criminal investigation.

- Compliance Checks: Banks periodically conduct compliance checks, and if an account fails to meet regulatory requirements, it may be frozen until the necessary verifications are completed.

Differences Between Centralized and Decentralized Wallets

- Control Over Assets: In centralized wallets (such as those offered by exchanges), the service provider has control over the wallets and can freeze accounts. In contrast, decentralized wallets like Trust Wallet give full control to the user, with the private keys stored locally on the user’s device.

- Response to Regulatory Actions: Centralized entities are more directly subject to regulatory actions and can freeze accounts as required by law. Decentralized wallets operate on a peer-to-peer basis, making it technically challenging for any single authority to freeze accounts.

- User Autonomy: Decentralized wallets offer greater autonomy and privacy, as they do not rely on a centralized authority that can freeze or restrict access. However, this also means users must be more proactive in securing their assets, as there’s no central authority to intervene in cases of fraud or theft.

Trust Wallet’s Policy on Account Freezing

Trust Wallet, as a decentralized wallet, emphasizes user autonomy and control, distinguishing its policy on account management significantly from that of traditional financial institutions or centralized cryptocurrency exchanges. Understanding Trust Wallet’s approach to account freezing, its stance on user autonomy, possible intervention scenarios, and the emphasis on user responsibility is crucial for users of the platform.

Trust Wallet’s Stance on User Autonomy

- Decentralized Nature: Trust Wallet operates on a decentralized model, meaning it does not have the authority to freeze accounts or access users’ funds directly. This model underscores the principle of user autonomy, where individuals have complete control over their digital assets.

- User Control: Users maintain control of their private keys, which are stored locally on their devices. This architecture ensures that users have the sole ability to manage and access their funds without intermediation.

Circumstances Under Which Trust Wallet May Intervene

- Technical Support: While Trust Wallet cannot freeze accounts, it can offer technical support and guidance in cases where users face issues with the wallet’s functionality, such as software bugs or interface problems.

- Security Advisories: Trust Wallet may issue security advisories or updates to help users protect their assets from known threats, vulnerabilities, or scams within the broader cryptocurrency ecosystem.

- Compliance and Education: Trust Wallet may provide information or tools to assist users in navigating regulatory compliance, particularly in jurisdictions with specific requirements for cryptocurrency holders. Additionally, the platform focuses on educating users on best practices for security and asset management.

The Importance of User Responsibility

- Securing Private Keys: Given the decentralized model, users are responsible for securing their private keys. Losing access to these keys means losing access to the wallet and its assets permanently.

- Phishing and Scams Awareness: Users must be vigilant against phishing attempts and scams. Trust Wallet emphasizes the importance of recognizing and avoiding malicious actors who may try to gain unauthorized access to wallets.

- Regular Updates: Keeping the wallet software up to date is crucial for security. Trust Wallet encourages users to install updates promptly to benefit from the latest security enhancements and features.

How to Safeguard Your Trust Wallet Account

Securing your Trust Wallet account is paramount to ensuring the safety of your digital assets. Given its decentralized nature, the responsibility for security largely falls on the user. Here are essential strategies for safeguarding your account, including the secure storage of your recovery phrase, maintaining the security of your app and device, and recognizing and avoiding phishing attempts.

Secure Storage of Your Recovery Phrase

- Physical Backup: Write down your recovery phrase on paper and store it in a safe, secure location that only you can access. Consider using a fireproof and waterproof safe for added protection.

- Avoid Digital Storage: Do not store your recovery phrase digitally (e.g., screenshots, text files, cloud storage) to avoid risks associated with hacking and digital theft.

- Multiple Copies: It’s advisable to keep multiple copies of your recovery phrase in different secure locations to prevent loss due to unforeseen circumstances.

Keeping Your App and Device Secure

- Regular Updates: Always keep your Trust Wallet app and mobile device’s operating system updated to the latest versions. Updates often contain security patches that protect against vulnerabilities.

- Security Software: Install reputable antivirus and anti-malware software on your device to prevent infections that could compromise your wallet.

- Lock Your Device: Use a strong password, PIN, or biometric lock for your device to prevent unauthorized access if it is lost or stolen.

Recognizing and Avoiding Phishing Attempts

- Be Skeptical of Unsolicited Contacts: Phishers often pose as support staff or affiliated partners. Always verify the authenticity of any unsolicited communication claiming to be from Trust Wallet.

- Check URLs Carefully: Before entering any sensitive information, ensure you’re on the legitimate Trust Wallet website or app. Phishing websites often mimic legitimate sites with slight variations in the URL.

- Do Not Share Your Recovery Phrase: Trust Wallet will never ask for your recovery phrase. Treat any request for your recovery phrase as a red flag and a potential phishing attempt.

- Educate Yourself: Stay informed about common phishing tactics and security best practices. Trust Wallet and other reputable sources offer resources and alerts about ongoing scams.

By adhering to these security measures, you can significantly reduce the risk of compromising your Trust Wallet account. The key to safeguarding your digital assets lies in diligent personal security practices, awareness of threats, and understanding the importance of your recovery phrase’s safekeeping.